Do You Get A Tax Form For Retirement Plans . how your retirement savings and income are taxed. Irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement. From 401 (k)s (fully taxed!) to social security (partially taxed). here's a breakdown of some common retirement income sources and a brief description of their federal tax implications. generally, yes, you can deduct 401 (k) contributions. get tax information for retirement plans: 62 rows find the forms, instructions, publications, educational products, and other related information useful for retirement. Required minimum distribution, contribution limits, plan types and reporting.

from its-taxes.com

get tax information for retirement plans: From 401 (k)s (fully taxed!) to social security (partially taxed). Required minimum distribution, contribution limits, plan types and reporting. Irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement. 62 rows find the forms, instructions, publications, educational products, and other related information useful for retirement. generally, yes, you can deduct 401 (k) contributions. how your retirement savings and income are taxed. here's a breakdown of some common retirement income sources and a brief description of their federal tax implications.

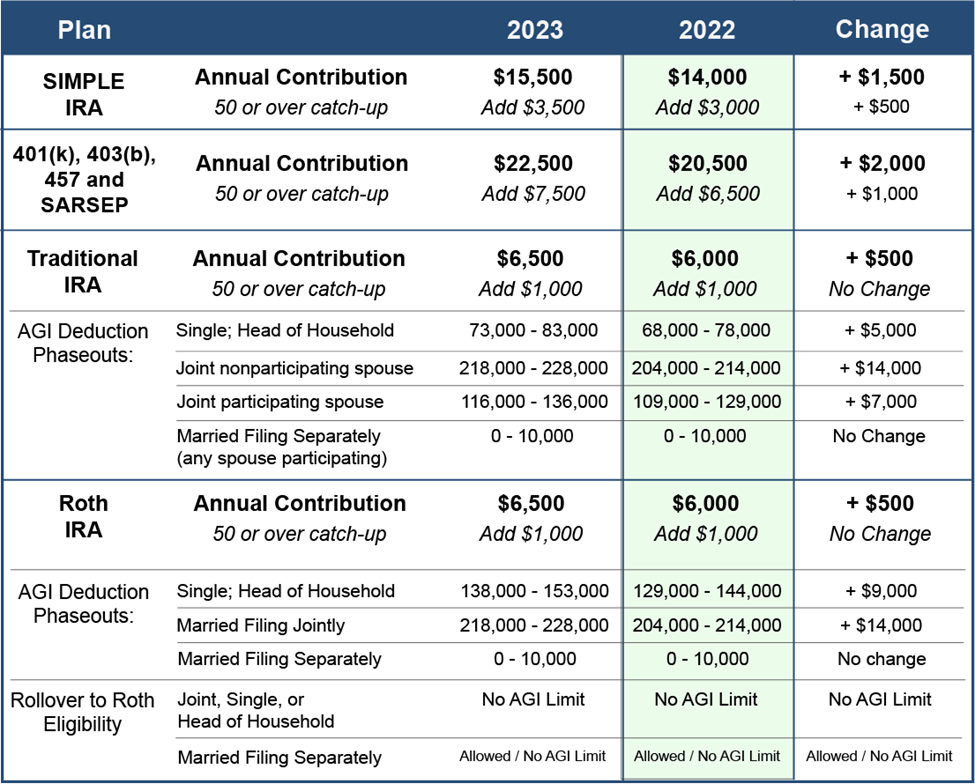

Plan Your Retirement Savings Goals for 2023 Integrated Tax Services

Do You Get A Tax Form For Retirement Plans From 401 (k)s (fully taxed!) to social security (partially taxed). 62 rows find the forms, instructions, publications, educational products, and other related information useful for retirement. how your retirement savings and income are taxed. Required minimum distribution, contribution limits, plan types and reporting. Irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement. get tax information for retirement plans: From 401 (k)s (fully taxed!) to social security (partially taxed). generally, yes, you can deduct 401 (k) contributions. here's a breakdown of some common retirement income sources and a brief description of their federal tax implications.

From www.uslegalforms.com

Sss Retirement Form 2020 Fill and Sign Printable Template Online US Legal Forms Do You Get A Tax Form For Retirement Plans how your retirement savings and income are taxed. Required minimum distribution, contribution limits, plan types and reporting. here's a breakdown of some common retirement income sources and a brief description of their federal tax implications. Irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement. generally,. Do You Get A Tax Form For Retirement Plans.

From www.wordtemplates.org

Retirement Plan Template Word Templates for Free Download Do You Get A Tax Form For Retirement Plans how your retirement savings and income are taxed. get tax information for retirement plans: From 401 (k)s (fully taxed!) to social security (partially taxed). Irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement. Required minimum distribution, contribution limits, plan types and reporting. here's a breakdown. Do You Get A Tax Form For Retirement Plans.

From careplanit.com

Taxes On Retirement CarePlanIt Do You Get A Tax Form For Retirement Plans 62 rows find the forms, instructions, publications, educational products, and other related information useful for retirement. Required minimum distribution, contribution limits, plan types and reporting. here's a breakdown of some common retirement income sources and a brief description of their federal tax implications. Irs form 8880 calculates how much of a tax credit you may qualify for if. Do You Get A Tax Form For Retirement Plans.

From www.youtube.com

Reduce Taxes in Retirement? A Basic Retirement Planning Strategy! YouTube Do You Get A Tax Form For Retirement Plans 62 rows find the forms, instructions, publications, educational products, and other related information useful for retirement. Required minimum distribution, contribution limits, plan types and reporting. here's a breakdown of some common retirement income sources and a brief description of their federal tax implications. From 401 (k)s (fully taxed!) to social security (partially taxed). generally, yes, you can. Do You Get A Tax Form For Retirement Plans.

From db-excel.com

Retirement Planning Spreadsheet — Do You Get A Tax Form For Retirement Plans here's a breakdown of some common retirement income sources and a brief description of their federal tax implications. generally, yes, you can deduct 401 (k) contributions. From 401 (k)s (fully taxed!) to social security (partially taxed). Irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement. . Do You Get A Tax Form For Retirement Plans.

From its-taxes.com

Plan Your Retirement Savings Goals for 2023 Integrated Tax Services Do You Get A Tax Form For Retirement Plans Required minimum distribution, contribution limits, plan types and reporting. Irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement. 62 rows find the forms, instructions, publications, educational products, and other related information useful for retirement. generally, yes, you can deduct 401 (k) contributions. get tax information. Do You Get A Tax Form For Retirement Plans.

From www.communitytax.com

Form 1099R Instructions & Information Community Tax Do You Get A Tax Form For Retirement Plans here's a breakdown of some common retirement income sources and a brief description of their federal tax implications. 62 rows find the forms, instructions, publications, educational products, and other related information useful for retirement. Irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement. Required minimum distribution,. Do You Get A Tax Form For Retirement Plans.

From www.youtube.com

How to report a 1099 R rollover to your self directed 401k YouTube Do You Get A Tax Form For Retirement Plans get tax information for retirement plans: 62 rows find the forms, instructions, publications, educational products, and other related information useful for retirement. Required minimum distribution, contribution limits, plan types and reporting. From 401 (k)s (fully taxed!) to social security (partially taxed). how your retirement savings and income are taxed. generally, yes, you can deduct 401 (k). Do You Get A Tax Form For Retirement Plans.

From www.youtube.com

Tax Free Retirement Plan YouTube Do You Get A Tax Form For Retirement Plans 62 rows find the forms, instructions, publications, educational products, and other related information useful for retirement. Irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement. get tax information for retirement plans: Required minimum distribution, contribution limits, plan types and reporting. generally, yes, you can deduct. Do You Get A Tax Form For Retirement Plans.

From www.annuityexpertadvice.com

What Is A TaxDeferred Retirement Plan? (2024) Do You Get A Tax Form For Retirement Plans how your retirement savings and income are taxed. 62 rows find the forms, instructions, publications, educational products, and other related information useful for retirement. Required minimum distribution, contribution limits, plan types and reporting. here's a breakdown of some common retirement income sources and a brief description of their federal tax implications. get tax information for retirement. Do You Get A Tax Form For Retirement Plans.

From lifetimeparadigm.com

A Quick Guide to Retirement Plans for Small Business Owners Lifetime Paradigm Do You Get A Tax Form For Retirement Plans how your retirement savings and income are taxed. get tax information for retirement plans: generally, yes, you can deduct 401 (k) contributions. Required minimum distribution, contribution limits, plan types and reporting. here's a breakdown of some common retirement income sources and a brief description of their federal tax implications. From 401 (k)s (fully taxed!) to social. Do You Get A Tax Form For Retirement Plans.

From www.remotefinancialplanner.com

Understanding Tax Season Form W2 Remote Financial Planner Do You Get A Tax Form For Retirement Plans 62 rows find the forms, instructions, publications, educational products, and other related information useful for retirement. how your retirement savings and income are taxed. here's a breakdown of some common retirement income sources and a brief description of their federal tax implications. Irs form 8880 calculates how much of a tax credit you may qualify for if. Do You Get A Tax Form For Retirement Plans.

From www.aotax.com

Tax tip to get tax benefits on retirement plan Do You Get A Tax Form For Retirement Plans how your retirement savings and income are taxed. Required minimum distribution, contribution limits, plan types and reporting. From 401 (k)s (fully taxed!) to social security (partially taxed). 62 rows find the forms, instructions, publications, educational products, and other related information useful for retirement. generally, yes, you can deduct 401 (k) contributions. get tax information for retirement. Do You Get A Tax Form For Retirement Plans.

From retiregenz.com

Where To Find Tax Deferred Pension And Retirement Savings Plans On 1040? Retire Gen Z Do You Get A Tax Form For Retirement Plans Irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement. here's a breakdown of some common retirement income sources and a brief description of their federal tax implications. 62 rows find the forms, instructions, publications, educational products, and other related information useful for retirement. get tax. Do You Get A Tax Form For Retirement Plans.

From www.sdcers.org

SDCERS Form 1099R Explained Do You Get A Tax Form For Retirement Plans Irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement. 62 rows find the forms, instructions, publications, educational products, and other related information useful for retirement. From 401 (k)s (fully taxed!) to social security (partially taxed). get tax information for retirement plans: here's a breakdown of. Do You Get A Tax Form For Retirement Plans.

From retirementbooklet.com

Retirement cheat sheet Retirement Guide Do You Get A Tax Form For Retirement Plans 62 rows find the forms, instructions, publications, educational products, and other related information useful for retirement. From 401 (k)s (fully taxed!) to social security (partially taxed). here's a breakdown of some common retirement income sources and a brief description of their federal tax implications. Irs form 8880 calculates how much of a tax credit you may qualify for. Do You Get A Tax Form For Retirement Plans.

From www.carboncollective.co

Qualified Retirement Plan How It Works, Investing, & Taxes Do You Get A Tax Form For Retirement Plans Required minimum distribution, contribution limits, plan types and reporting. here's a breakdown of some common retirement income sources and a brief description of their federal tax implications. generally, yes, you can deduct 401 (k) contributions. Irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement. From 401. Do You Get A Tax Form For Retirement Plans.

From www.financestrategists.com

Retirement Plan Conversion Meaning, Reasons, & Scenarios Do You Get A Tax Form For Retirement Plans From 401 (k)s (fully taxed!) to social security (partially taxed). here's a breakdown of some common retirement income sources and a brief description of their federal tax implications. Required minimum distribution, contribution limits, plan types and reporting. Irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement. . Do You Get A Tax Form For Retirement Plans.